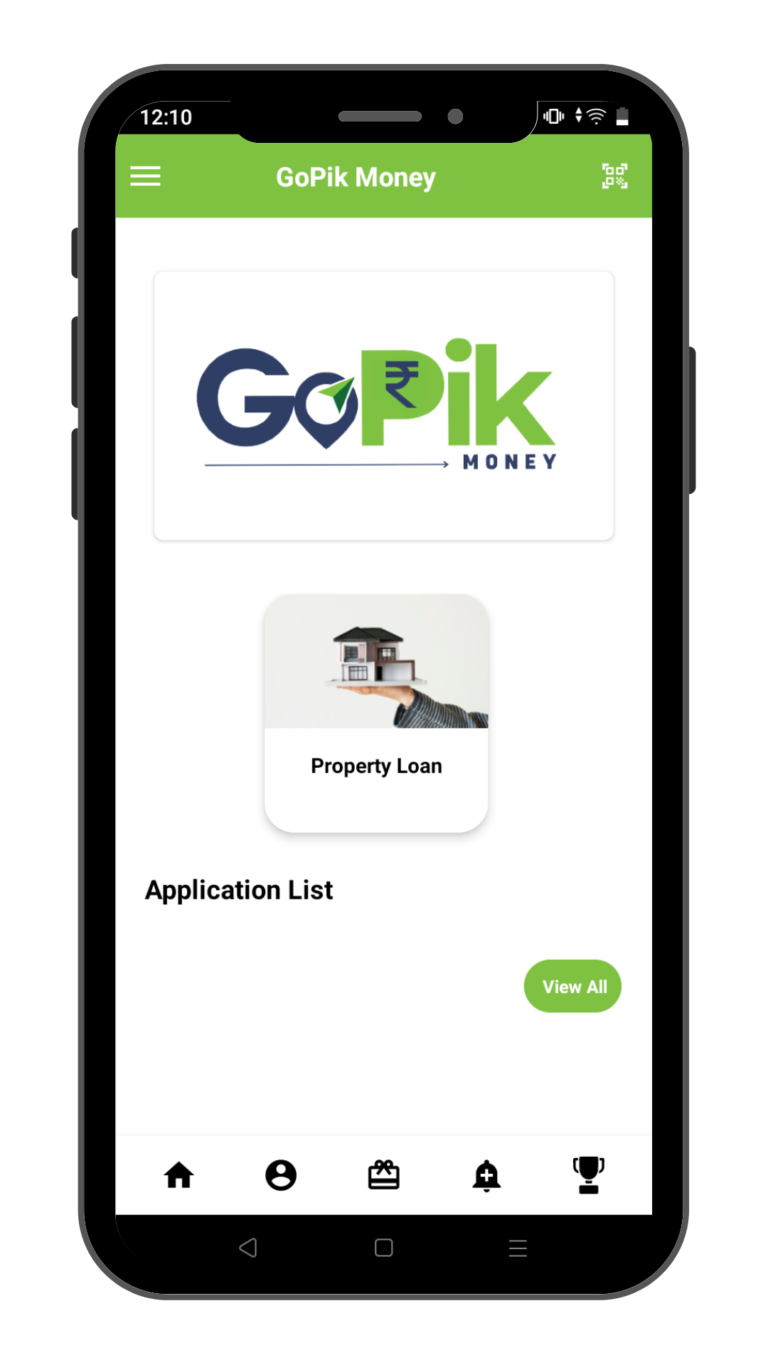

Move into your own house with Gopik.

What is a Property Loan?

We understand having your own home is a huge milestone for you, thus we brought you the Gopik’s Property loans for your Assistance. Enjoy predetermined attractive interest rates with many other benefits. Contact us now for further assistance.

Features and Benefits

Fast Approval

Multiple documentation, long waiting weeks or sometimes even months, is what Gopik subtracts from the equation. Over the traditional loan providers, we provide a secure and quick procedure that will get your loan approved quickly, if you are eligible for the Loan. All you have to do is connect to your broker.

Digital process

Why waste paper in this digital era when everything can be done digitally? It makes the process hassle-free and much more user-friendly. That's how Gopik aims to achieve the dual purpose of contributing to the conservation of Nature and giving its customers the best service.

Lowest interest rates

Gopik offers affordable loans Starting from 10 Lakhs and above with interest rates starting as low as 7% p.a. Please Note that the final rate offered on interest is affected by factors like applicants’ monthly income, and credit score, among others, and is solely at the discretion of Gopik.

Repayment Tenure of your Choice

With Gopik you get to choose from the flexible repayment period. So, with your choice, you get to extend the loan tenure up to 30 Years.

No hidden Fees

Gopik Never charges any fees on any of its products from its customers. You get can this benefit from Gopik’s all loan services. The offer is available to all eligible customers. Contact Gopik to know your eligibility.

Property Loan Interest Rates and Charges

- Interest Rate: 7 to 16% p.a. onwards

- Loan Amount: 10 Lakhs and above

- Tenure: Upto 30 Years

- Processing Charges: Less than 0.5%

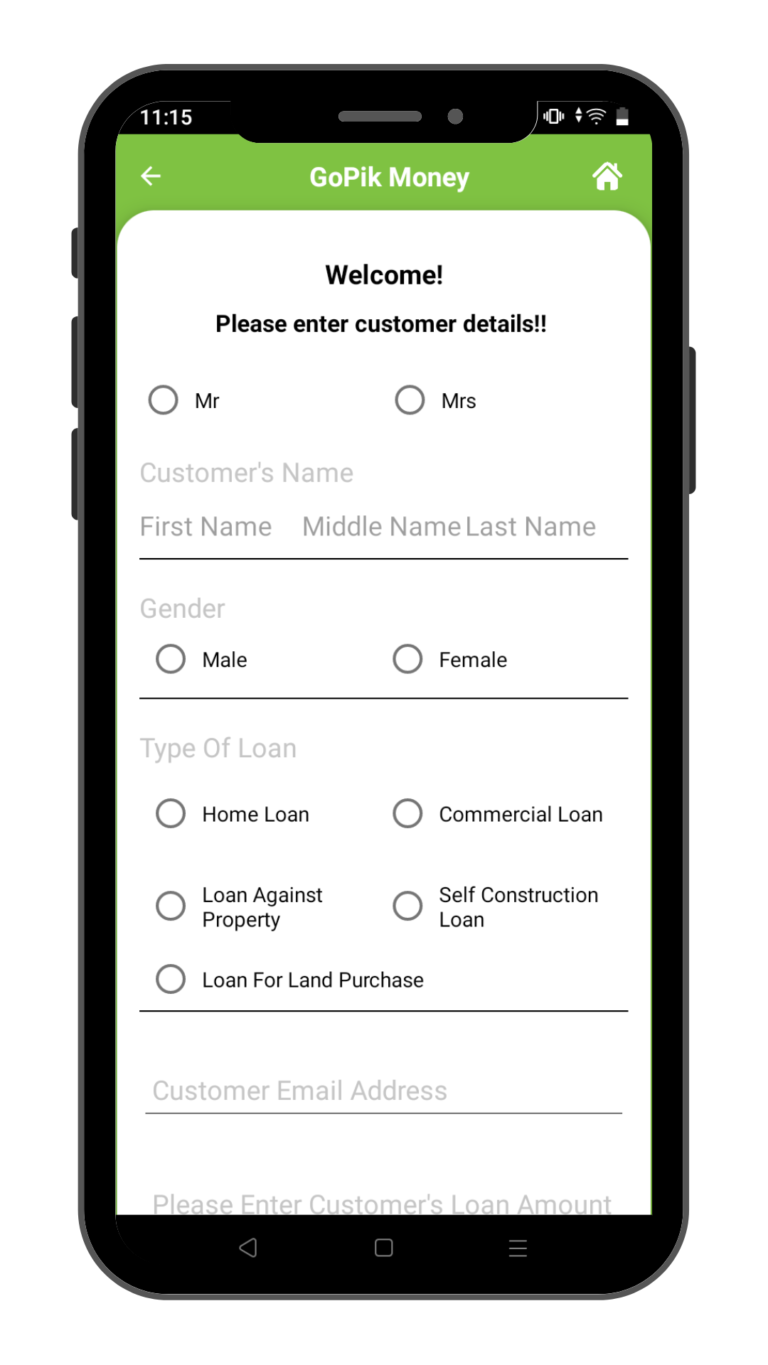

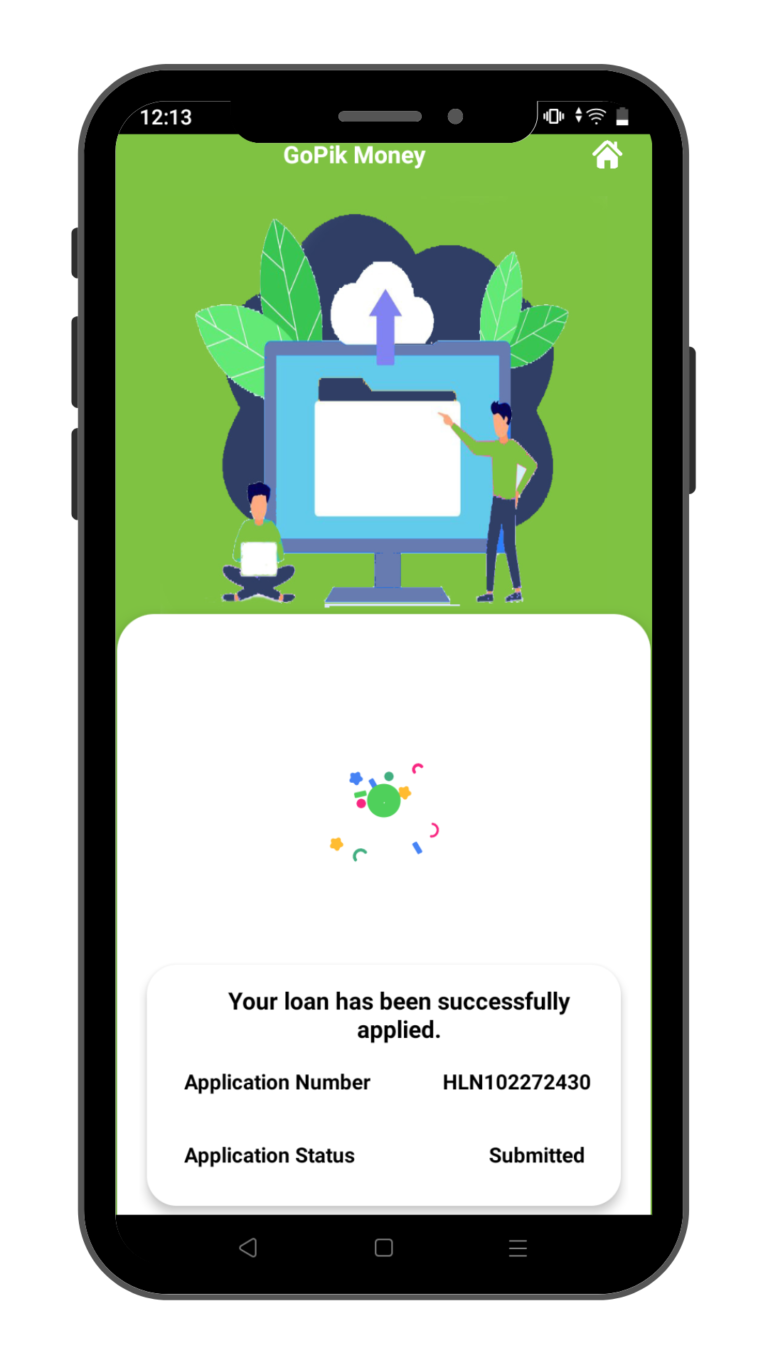

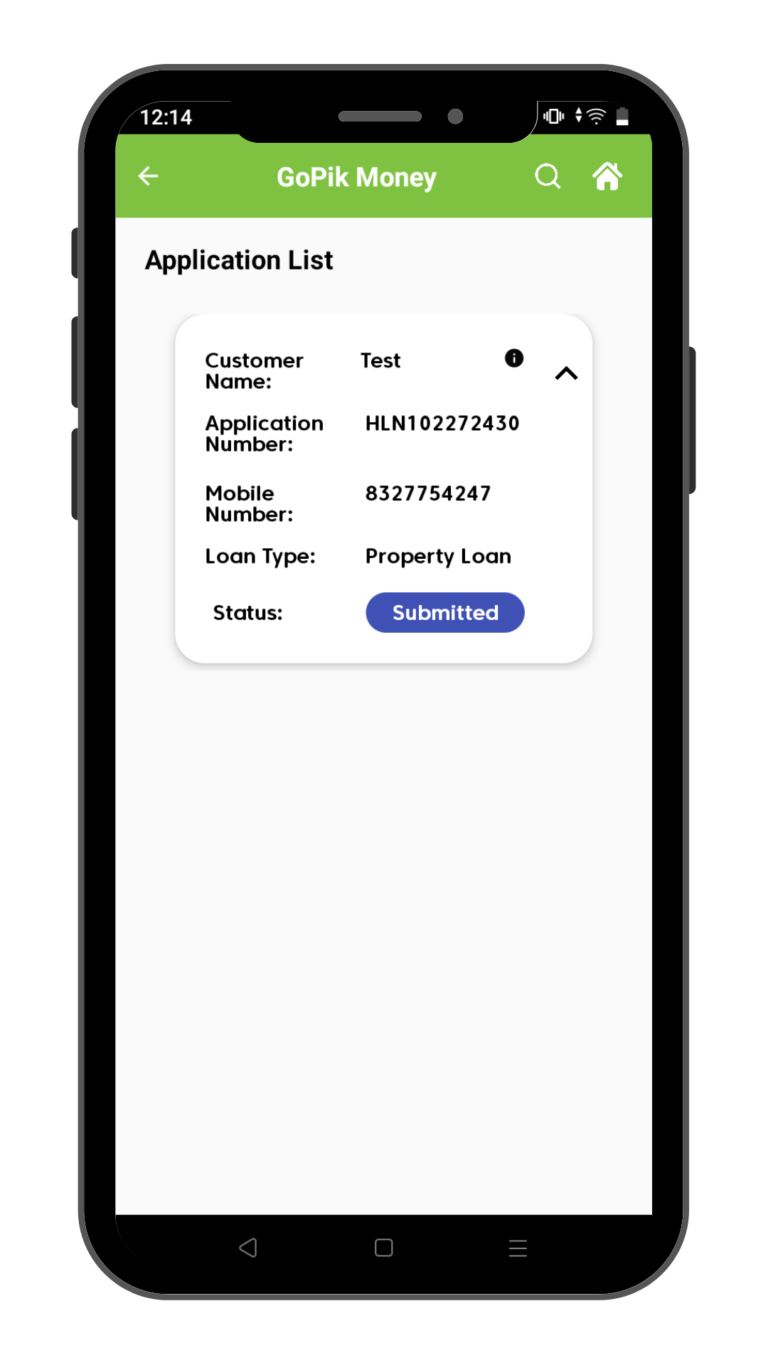

How to Apply for Gopik Property Loan?

- Connect with Broker

- Select the Loan Details

- Fill basic KYC Details

- Check your Eligibility

- Do E-Nach and get your loan disbursed

Property Loan Eligibility Criteria

- Applicant should be an Indian national Resident

- Salaried or Self Employed

- Age 21 to 58

Documents Required for Application

- Standard document as applicable to respective financier.

- ID Proof ( Pan Card / Voter / Aadhar Card )

- Address Proof ( Voter / Aadhar Card )

- Income Doc.

- Property Docs.